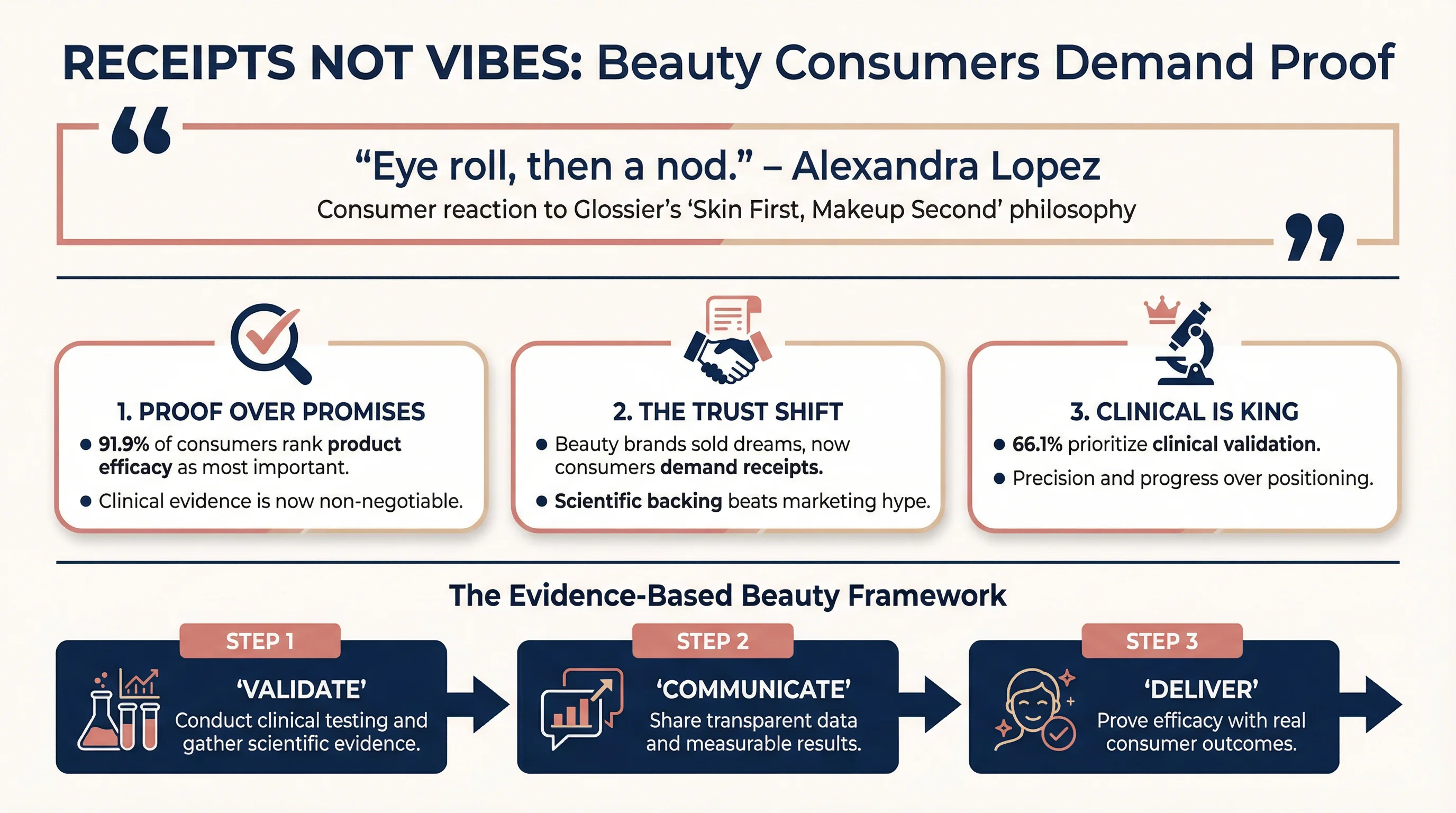

"Eye roll, then a nod." That was Alexandra Lopez's reaction when I tested Glossier's "Skin First, Makeup Second" philosophy with six American consumers. The positioning resonates as a north star, but philosophy alone does not drive conversion.

The verdict? Receipts, not vibes. Consumers want proof of performance, not aspirational messaging.

The Participants

Six participants from diverse backgrounds: a spa operations manager in Syracuse, an operations manager in Lakewood, a retail merchandiser in rural Maryland, a content producer in rural New York, a food-service worker in Flint, and an auto sales professional in rural North Carolina. Ages ranged from 21 to 43, incomes from $28k to $245k. What united them? They all buy beauty products and have seen enough marketing to be sceptical of claims without proof.

Does the Philosophy Resonate?

I asked participants how they react to "Skin First, Makeup Second" as a brand philosophy. The response was broadly favourable, but conditional.

Alexandra Lopez captured it perfectly: "Eye roll, then a nod." The positioning works as an antidote to heavy coverage and performative beauty messaging. But trust is only earned through tangible proof:

Demonstrated performance - hydration, no pilling, SPF without white cast

Ingredient transparency - INCI lists, percentage actives, pH and stability notes

True inclusivity - SPF performance on deeper skin tones, shade breadth

Fair pricing - not a premium for minimalism

Christopher Lim, a high-income analytical shopper, emphasized the need for "proof, not poetry." Aspirational messaging without clinical evidence registers as marketing noise.

Key insight: The philosophy resonates as a credible north star, but does not drive conversion without performance validation. Vibe-driven marketing triggers scepticism.

What Triggers DTC Purchase Over Retail?

I asked what would make participants buy direct from Glossier rather than picking it up at Sephora or Ulta. The answer was clear: DTC wins only when it demonstrably removes practical advantages of in-store shopping.

The conversion levers, in priority order:

Time and reliability - fast/free shipping with accurate ETAs, live tracking, 2-3 day delivery promise

Trust and risk reduction - no-risk shade swaps, printerless QR returns with instant credit, credible samples

Transparency and evidence - INCI lists, percentage actives, SPF performance on diverse skin tones

Low-friction operations - guest checkout, Apple/Google Pay, minimal marketing follow-up

Functional value - online-only sizes that beat price-per-ounce at retail, refill options

Stephanie Sanchez, a personal-care professional, prioritized operational excellence and clinical proof. Nolan Ohara, a young lower-income shopper, was driven by immediate price/value and rapid delivery.

Key insight: Shoppers buy direct only when DTC beats stores on time, trust, and total cost. Fast shipping, no-risk returns, and credible swatching are the table stakes.

The $40 Free Shipping Threshold

I tested whether a $40 free-shipping threshold would nudge spending. The answer: conditional at best.

Stephanie Sanchez nailed the dynamic: "If I'm at $34, I'll toss in the brow gel... If I'm at $19, it feels like a shove."

The threshold works when:

Carts are already near the line

Add-ons are practical staples or refills

Delivery promises are reliable

The threshold fails when:

No clear value justification for the add-on

Delivery promises lack credibility

Threshold feels arbitrary rather than incentivizing

More decisive factors than the threshold: accurate ETAs, climate-safe packaging with replacement guarantees, and printerless returns with instant credit.

Key insight: A $40 free-shipping threshold alone is insufficient. It nudges spending only when paired with genuine value and credible delivery promises.

Shared Mindsets Across Segments

Seven patterns emerged consistently across all participant segments:

Scepticism of vibe-driven marketing - aspirational copy triggers mistrust without proof

Demand for performance evidence - INCI, clinical notes, texture videos expected before purchase

Preference for minimal, effective routines - fewer multifunctional products if reliably effective

Operational convenience as DTC differentiator - fast shipping, no-risk returns, meaningful samples

Shade confidence required - SPF and base products must perform on darker tones with honest swatches

Sustainable packaging must be functional - refills, locking pumps, travel-ready caps

Privacy and low-friction checkout - guest checkout, mobile wallets, minimal marketing follow-up

Key insight: Universal scepticism of vibe-driven marketing. Trust is earned through INCI transparency, clinical evidence, and reliable DTC operations.

What This Means for Beauty Brands

If you are positioning around "skin first" or minimalist beauty, here is what actually converts:

Proof-first product pages. INCI, percentage actives, pH/stability notes, fragrance level, price per ml, texture videos on diverse skin, SPF no-white-cast demos.

One-time free shade swap with QR returns. Printerless returns with instant credit. Reduce risk to zero.

Explicit shipping promises at checkout. Live ETA, 2-3 day default, locker/pickup options, no hidden fees.

Choose-your-own samples with credit toward full sizes. Let customers test before committing.

Threshold-aware "top-up staples" widget. Surface refills under $10 when carts near $40.

The Bottom Line

"Skin First, Makeup Second" has genuine appeal as a north star, but conversion depends on proof, not poetry. Aspirational messaging triggers scepticism. Clinical evidence, reliable operations, and fair pricing earn trust.

As Christopher Lim put it: the brand needs "receipts, not vibes." INCI transparency, no-risk shade swaps, and 2-3 day delivery SLAs are the path to converting retail shoppers to DTC loyalists.

Want to test your own beauty positioning? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real consumers to share their thoughts. Here is what they told us:

How do you react to Glossier's "Skin First, Makeup Second" philosophy?

Stephanie Sanchez, 37, Regional Operations Manager, Syracuse, NY, USA:

Favourable but conditional. The philosophy resonates as an antidote to heavy coverage messaging. Trust is earned through hydration that delivers, SPF without white cast, and ingredient transparency I can verify.

Alexandra Lopez, 33, Spa Operations Manager, Lakewood, CO, USA:

Eye roll, then a nod. The positioning works if backed by performance. I want INCI lists, percentage actives, texture videos in harsh light, and honest swatches for darker skin tones.

Christopher Lim, 35, Senior Retail Merchandiser, Rural MD, USA:

Proof, not poetry. The philosophy is credible as a north star but means nothing without clinical evidence, ingredient-level transparency, and price-per-ml calculations that justify the premium.

What would make you buy direct from Glossier instead of at Sephora?

Stephanie Sanchez, 37, Regional Operations Manager, Syracuse, NY, USA:

Fast reliable shipping with accurate ETAs. No-risk shade swaps with printerless returns and instant credit. Clinical proof on the product page. Guest checkout without marketing harassment.

Nolan Ohara, 21, Food-Service Worker, Flint, MI, USA:

Price and speed. If DTC beats Sephora on price-per-ounce and delivers in 2 days with free shipping, I will buy direct. Otherwise I will grab it when I am already at the store.

Gerald Anderson, 41, Auto Sales Professional, Rural NC, USA:

Online-only value. Larger sizes or bundles that beat retail unit economics. Refill options that make repeat purchases cheaper. Clear returns policy without printer or post office hassle.

Would a $40 free-shipping threshold influence your cart size?

Stephanie Sanchez, 37, Regional Operations Manager, Syracuse, NY, USA:

Depends where I start. If I am at $34, I will toss in the brow gel. If I am at $19, it feels like a shove. The threshold works when the add-on is a practical staple, not a manipulation.

Alexandra Lopez, 33, Spa Operations Manager, Lakewood, CO, USA:

Conditionally. More decisive factors: accurate ETAs, climate-safe packaging, instant credit returns. The threshold is a nudge, not a driver.

Armando Glidden, 43, Content Producer, Rural NY, USA:

Mild influence. I will add a refill if I am close. I will not stretch to $40 from $25 just for free shipping. The value has to make sense independent of the threshold.