I asked 10 Canadian consumers a simple question: what actually makes you walk past the Loblaws and into a natural grocery store? Their answers challenge almost everything the natural retail industry assumes about its own customers.

Natural grocery retail in Canada is having a moment. Stores like Nature's Fare, Whole Foods, and independent health food shops are expanding across provinces, each promising a curated experience that mainstream supermarkets can't match. But here's the thing: are shoppers actually buying that promise? Or are they making far more pragmatic calculations than retailers realise?

We ran a synthetic consumer research study through Ditto with 10 Canadian participants aged 28 to 54, spanning income brackets from $9,600 to $149,000 across Ontario, Quebec, and British Columbia. We asked them seven questions about store choice, staff expertise, sustainability, pricing, loyalty programmes, product discovery, and experiential retail.

The results were not what I expected.

The Big Finding: Pragmatic, Not Ideological

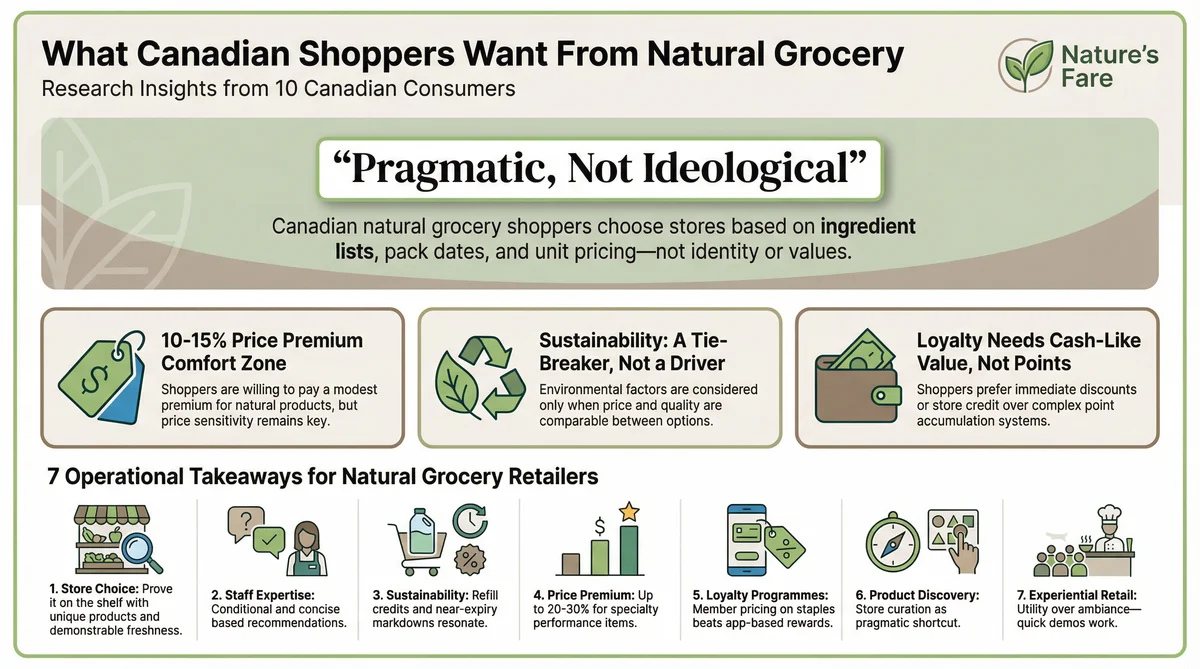

If there is one phrase that defined this entire study, it was this: "pragmatic, not ideological." Canadian natural grocery shoppers are not choosing these stores because of identity or values. They are choosing them because of ingredient lists, pack dates, and unit pricing.

That is a fundamental reframing. The natural retail industry has spent years building marketing around lifestyle, wellness identity, and community belonging. But the consumers in this study described their decision-making in entirely operational language. The most frequently used words across all 70 responses? "Price" (115 mentions), "real" (95), "store" (85), "bulk" (84), and "short" (83, as in short ingredient lists).

Not a single lifestyle or wellness term cracked the top 10.

What the Research Revealed

Store Choice: Prove It on the Shelf

When asked what makes them choose a natural grocery store over a mainstream supermarket, participants gave remarkably consistent answers. The decision comes down to:

Unique products they genuinely cannot find elsewhere

Demonstrable freshness (visible pack and harvest dates)

Cleaner ingredient lists that are short enough to read in the aisle

Bulk and refill economics that beat mainstream unit prices

Time savings through better store layout and curation

What DOESN'T work? Vague wellness claims and aggressive upselling. Multiple participants flagged these as trust-breakers, not trust-builders.

Staff Expertise: Conditional and Concise

The role of knowledgeable staff is more nuanced than natural retailers might hope. Staff expertise has high conditional value, but only when it meets specific criteria: concise, label-focused, and budget-aware.

Fact-based recommendations shift purchases. Long explanations or moralising about ingredients push shoppers away.

The operational signals that actually build trust are surprisingly mundane: visible pack and harvest dates, clear unit pricing, reliable inventory, and fast checkout. Staff who can point to specific label differences between products change buying behaviour. Staff who deliver wellness lectures create resistance.

Sustainability: A Tie-Breaker, Not a Driver

This was perhaps the most sobering finding for retailers who lead with their environmental credentials. Sustainability is a tie-breaker, not a driver. It rarely overrides price, convenience, or routing decisions.

When sustainability messaging does resonate, it needs to be tangible and measurable:

Refill credits with measurable savings (not vague "eco" promises)

Near-expiry markdowns that reduce waste AND save money

Clean bulk formats with visible unit economics

Recyclable packaging that doesn't require a guide to understand

Greenwashing and app-only sustainability benefits actively weaken trust. Consumers can tell the difference between genuine environmental commitment and marketing.

Price Premium: The 10-15% Comfort Zone

On pricing, the data was remarkably precise. Canadian natural grocery shoppers accept a 10-15% basket premium ($5-$15 per shop) as their comfort zone. For individual performance items like specialty supplements, adaptogens, or high-quality proteins, they will stretch to 20-30%.

But there are clear limits. Generic items (staples, basics, pantry goods) have almost zero premium tolerance. The moment shoppers start doing mental maths comparing unit prices against mainstream alternatives, the spell breaks. Every premium must be "clearly justified" with demonstrable quality, freshness, or waste reduction.

Loyalty Programmes: Cash, Not Points

The verdict on loyalty programmes was unanimous and direct. Effective programmes need three things:

Low friction (no complex point systems, no app requirements)

Transparent, cash-like value (member pricing on staples, instant credits)

Relevance to actual purchases (not arbitrary categories or aspirational rewards)

Points requiring apps, exclusive products, and early access without direct savings were universally flagged as ineffective. Shoppers want member pricing on the items they already buy, not gamified reward systems that require a spreadsheet to understand.

Product Discovery: Store as Shortcut

How do consumers find new natural products? Primarily through store curation as a pragmatic shortcut. They trust the store's selection as a quality filter, but it is not blind trust. The discovery cues that actually work:

Short ingredient lists (the fewer items, the more trust)

Visible pack and harvest dates

Unit prices displayed alongside mainstream equivalents

Consistent brand presence across visits

Staff recommendations that are label-focused, not story-focused

Online research and word of mouth serve as secondary channels that can override in-store displays if the shelf signals don't match. Consistency between what the store claims and what the labels show is everything.

Experiential Retail: Utility Over Ambiance

In-store experiences like cooking classes, wellness consultations, and tastings? Cautiously positive, but ONLY when they deliver immediate, measurable utility.

High-potential experiences include quick cooking demos that reduce prep time, bulk and refill consultations that save money, and allergen or sensitivity consultations with concrete product recommendations. What falls flat? Ambiance-only events, wellness consultations without a product payoff, and tastings that feel like upselling disguised as generosity.

The Consumer Segments That Emerged

Five distinct consumer segments emerged from the research, each with different priorities and premium tolerance:

Suburban Commuters (ages 50-54): Prioritise operational convenience. They want parking, speed, clear unit pricing, and demonstrable freshness. Premium tolerance sits at 10-15% and only for items with visible provenance.

Quebec Francophone Shoppers: French-first labels and local Quebec provenance are essential. English-first communications actively weaken conversion. This segment demands cultural alignment, not just translation.

Parents and Caregivers: Driven by kid acceptance, waste avoidance, and small or trial sizes. They will accept modest premiums if products reduce waste or their children actually consume them. Clear allergen labelling is non-negotiable.

Value-Sensitive Shoppers (under $49K income): Receipt and ledger-focused. Every purchase justified by explicit price comparisons. Bulk appeal exists only when unit economics demonstrably beat mainstream options.

Young Urban Professionals (ages 28-33, $100K+): Prioritise selection, time savings, and performance-focused products. Willing to pay 30%+ premiums for performance or convenience items. Reliable inventory and errand reduction matter more than price.

What This Means for Natural Grocery Retailers

The implications for retailers like Nature's Fare are significant. Here are the seven operational takeaways from this research:

Lead with proof, not promises. Pack dates, unit pricing, ingredient counts. Visible shelf signals outperform narrative marketing every time.

Segment by language and region. Quebec francophones require French-first, local-provenance messaging. A national approach will leave money on the table.

Right-size the assortment. Trial and small sizes unlock the parent and cautious-buyer segments who want to try without committing.

Make refill economics instant. Bulk and refill programmes succeed only when unit savings are immediate and calculable. No mental maths required.

Train staff on facts, not stories. Fact-based, concise product knowledge (benefits per ingredient) beats wellness storytelling.

Keep experiences utilitarian. Demos and tastings work only when directly linked to purchase decisions or prep-time savings.

Redesign loyalty around staples. Member pricing on everyday items plus instant credits. Drop the points systems and app requirements.

The Bottom Line

Canadian natural grocery shoppers are not the values-driven idealists that the industry's marketing often assumes. They are pragmatic consumers making calculated decisions based on ingredient transparency, unit economics, and operational convenience. The retailers who understand this, who lead with proof instead of promises, will win their basket spend. The ones who keep leaning on wellness identity and lifestyle marketing will keep wondering why conversion rates plateau.

The full research study, including all 70 individual responses and AI-generated segment analysis, is available to explore below.