Six Americans. Three questions about where they put their savings. One surprising consensus: they do not trust fintech apps with their emergency funds. Not because the technology confuses them. Not because the rates are bad. Because they cannot shake the fear that when they actually need the money, something will go wrong.

I ran a Ditto study to understand how regular US consumers (not tech bros, not finance people, just regular folks balancing budgets and raising kids) actually feel about robo-advisors like Wealthfront. The responses were remarkably consistent, and remarkably skeptical.

The Participants

Our panel included six Americans aged 33-54, spread across Texas, California, Wisconsin, and Pennsylvania. They ranged from stay-at-home parents to administrative assistants to sales professionals. Household incomes spanned under $25k to over $100k. What united them: all manage tight budgets, all have used banking apps, and all have opinions about where their money should live.

The Robo-Advisor Reaction

When we asked about their gut reaction to 'automated investing' and 'robo-advisors,' the responses fell into a clear pattern. One word kept appearing: trust.

Gut reaction: eye roll. 'Automated investing' sounds like one more shiny app trying to skim a fee while burying the rules in fine print.

Holly, a 33-year-old stay-at-home parent from rural Pennsylvania, nailed the skepticism: she trusts her calendar and her spreadsheet more than an algorithm. Another participant, Stephanie from Wisconsin, was more direct: 'A computer choosing what to do with my tiny savings... I don't like that.'

The pattern was consistent. Participants were not confused by the technology. They understood what robo-advisors do. They simply did not believe the apps would be there for them when something went wrong.

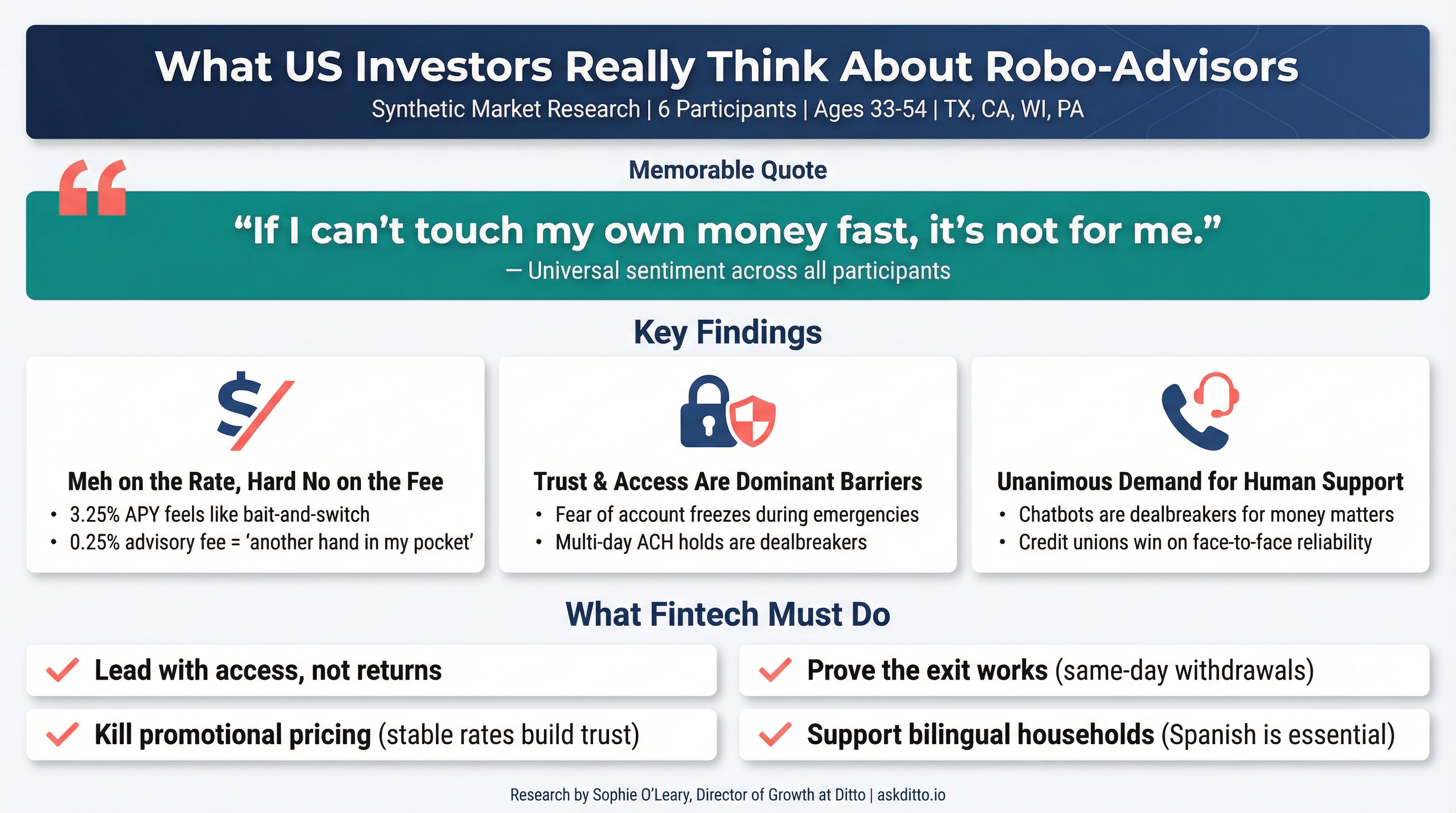

Key insight: The barrier to robo-advisor adoption is not technological literacy. It is emotional trust. Consumers need proof of human backup before they will consider automated money management.

The Pricing Problem

We showed participants Wealthfront's core value proposition: a cash account at 3.25% APY (up to 3.90% with promotion) and automated investing for a 0.25% annual fee. The reaction was unanimous and damning.

Meh on the rate, hard no on the fee.

Stephanie from Racine put it bluntly: the 3.25% is 'fine,' but promos 'come and go, and then they drop it and you're stuck moving money again.' The 0.25% advisory fee? 'For me, paying a fee to let a robot pick things is a no.'

Every participant flagged the promotional rate as suspicious:

'Promos siempre tienen letra chiquita' (promos always have fine print)

'The promo smells like hoops and a timer'

'If it needs three friends, a direct deposit, and a blood moon, hard pass'

'Teaser city' concerns across the board

The fee stacking concern was universal. Participants understood that the 0.25% advisory fee sits on top of underlying ETF expense ratios. As Rachel from Fresno noted: 'That's a forever skim on top of the fund expense ratios.'

Key insight: Promotional rates trigger deep skepticism, not excitement. Consumers see them as 'bait' that will 'drop the second you blink.' Simple, stable pricing beats flashy introductory offers.

The Switching Barrier

We asked what would make participants switch to something like Wealthfront, and what their single biggest barrier was. The answers were remarkably specific and consistent.

The #1 barrier: trust around access. Not trust in the algorithm. Trust that they can get their money fast when life happens.

If I can't touch my own money fast, it's not for me.

Participants described specific nightmare scenarios:

Security reviews that freeze funds when rent is due

3-5 business day ACH holds during emergencies

Chatbot support when they need human help

Car repairs on Friday with money stuck until Wednesday

The comparison point was always the same: their local credit union. As Nickalous from San Diego explained: 'My local credit union is 10 minutes away. If you cannot beat the speed and certainty of that, I am not switching.'

What would make them consider switching? The requirements were extensive but reasonable:

Instant, free transfers - same-day ACH, no mystery holds

Real human phone support - not chatbots, not tickets, actual people

Clear FDIC coverage - which banks hold the money, in plain language

No teaser games - stable rates that don't vanish after 3 months

Spanish language support - critical for bilingual households

Simple envelope/bucket features - label goals, move money with one tap

Key insight: Robo-advisors need to prove operational reliability before anything else. The winning message is not 'better returns' but 'you can access your money instantly, always, with a human to help if needed.'

What This Means for Fintech Platforms

If you are building or marketing a robo-advisor platform, this research suggests a fundamental repositioning:

Lead with access, not returns. The fear of frozen funds outweighs any APY advantage.

Kill promotional pricing. Teaser rates destroy trust. A stable 3% beats a promo 4% that might disappear.

Invest in phone support. Chat-only is a dealbreaker. Real humans answering real calls in under 5 minutes.

Prove the exit works. Show withdrawals landing same-day. Let prospects test it with small amounts first.

Acknowledge the competition honestly. The real competitor is not other fintechs. It is the credit union down the street where they can walk in and solve problems face-to-face.

Support bilingual households. Spanish language support is not a nice-to-have for millions of American families.

The Bottom Line

Robo-advisors have a trust problem that better marketing cannot solve. These consumers are not uninformed or technophobic. They are rationally skeptical based on real experiences with apps that froze transfers, buried fees in fine print, and replaced human support with chatbots.

The path forward is not more features or higher rates. It is proving, with real operational excellence, that the money is always accessible and help is always available. Until fintech platforms can match the reliability of a local credit union, not just the returns, they will struggle to win mainstream adoption.

Want to test your own fintech positioning with real consumer reactions? Ditto lets you run studies like this in hours, not weeks. Book a demo at askditto.io.

What the Research Revealed

We asked real consumers to share their thoughts. Here's what they told us:

When you hear 'automated investing' or 'robo-advisor', what is your gut reaction?

Amanda Velasquez, 43, Baker, Arlington, TX:

Gut reaction? Meh, not for me. Sounds like something for people who already have money sitting around. An algorithm with my rent money feels cold, and when it loses, the app just says 'markets go down' while I'm over here juggling groceries and gas. I trust a real person at my little bank more than a fancy app I can't look in the eye.

Stephanie Ortega, 36, Stay-at-Home Parent, Racine, WI:

Gut reaction? Meh, no. Feels cold and a little scary. A computer choosing what to do with my tiny savings... I don't like that. I need to see it, touch it, move it fast if the rent or boots pop up.

Holly Fudge, 33, Stay-at-Home Parent, Rural, PA:

Gut reaction: eye roll. 'Automated investing' sounds like one more shiny app trying to skim a fee while burying the rules in fine print. I trust my calendar and my spreadsheet more than an algorithm that changes settings when my Wi-Fi hiccups.

Colleen O'Connor, 54, Sales Professional, Rural, PA:

My gut on 'automated investing' is it sounds slick and a little grabby. I don't love trusting a black box with our savings. A calculator is fine. An algorithm that won't pick up the phone when something looks off? Hard pass.

Nickalous Dias, 44, Administrative Assistant, San Diego, CA:

Gut reaction: cautiously pro. I like automation for boring, long-term buckets because my weekdays are slammed. I trust an algorithm more than a commissioned salesperson, but only if I can see the rules, the fees, and the fail-safes.

Rachel Sanchez, 35, Customer Success Manager, Fresno, CA:

Gut reaction? Suspicious, then tempted. I like the idea of set-it-and-forget-it because I don't want to babysit charts after work, but I also don't trust a black box with my money just because it has cute graphs.

How do Wealthfront's numbers land with you?

Stephanie Ortega, 36, Stay-at-Home Parent, Racine, WI:

Gut check? Meh on the rate, hard no on the fee. 3.25% is fine, but promos like 3.90% come and go, and then they drop it and you're stuck moving money again. That 0.25% on the investing... for me, paying a fee to let a robot pick things is a no.

Colleen O'Connor, 54, Sales Professional, Rural, PA:

The 3.25% APY looks fine, better than my credit union most days, but the 'up to 3.90% with promotion' makes me side-eye. Promos usually mean hoops or a time limit.

Rachel Sanchez, 35, Customer Success Manager, Fresno, CA:

Gut reaction: the cash APY looks fine, not mind-blowing. The promo smells like a carrot on a stick. I hate teaser rates because they drop the second you blink. The 0.25% robo fee is... okay, but if it's just sticking you in basic index funds, that's a forever skim.

Amanda Velasquez, 43, Baker, Arlington, TX:

Gut reaction: 3.25% on cash sounds decent, and 3.90% promo makes my ears go up... but promos siempre tienen letra chiquita (promos always have fine print).

Nickalous Dias, 44, Administrative Assistant, San Diego, CA:

Quick gut check: 3.25% APY feels light right now. The 3.90% promo smells like hoops and a timer. I do not chase teaser rates unless the transfers are fast and there are zero gotchas.

Holly Fudge, 33, Stay-at-Home Parent, Rural, PA:

Quick take: 3.25% APY feels light. The 3.90% promo smells like hoops and a drop-off later. I do not build my budget on teaser rates.

What would make you switch from your current bank?

Amanda Velasquez, 43, Baker, Arlington, TX:

Short answer: I'd switch if it actually respects my money and my time. Single biggest barrier: trust and access. I can't risk a 'security review' holding my money when rent is due, and I won't gamble what little I have on investments that can drop.

Rachel Sanchez, 35, Customer Success Manager, Fresno, CA:

Short answer: I'm not anti-app, I'm anti-surprises. Single biggest barrier: trust in access when it hits the fan. If my car dies or PG&E double-bills, I need cash today, not 'funds available in 4-5 business days.'

Nickalous Dias, 44, Administrative Assistant, San Diego, CA:

Short version: pay me fairly for my cash, let me move money instantly, and give me a real human when something breaks. Single biggest barrier: trust around access. I do not park our emergency fund where a random 'security review' can trap it.

Stephanie Ortega, 36, Stay-at-Home Parent, Racine, WI:

Short answer: I don't switch unless it makes my life cheaper, safer, and faster. Biggest barrier: trust. I'm scared the app freezes my money or puts a hold the week I need to pay rent.

Holly Fudge, 33, Stay-at-Home Parent, Rural, PA:

Single biggest barrier: trust plus switching time. I don't trust new fintechs to pick up the phone when something breaks, and I do not have a weekend to untangle direct deposit.

Colleen O'Connor, 54, Sales Professional, Rural, PA:

Short version: I'd switch if it actually makes my life easier and they stop playing games. The single biggest barrier: I do not trust app-only outfits to be there when something breaks, and I can't have emergency cash stuck in ACH limbo.