Canadian winters are brutal. Minus 19 degrees, icy sidewalks, snow piling up. The perfect conditions for food delivery, right?

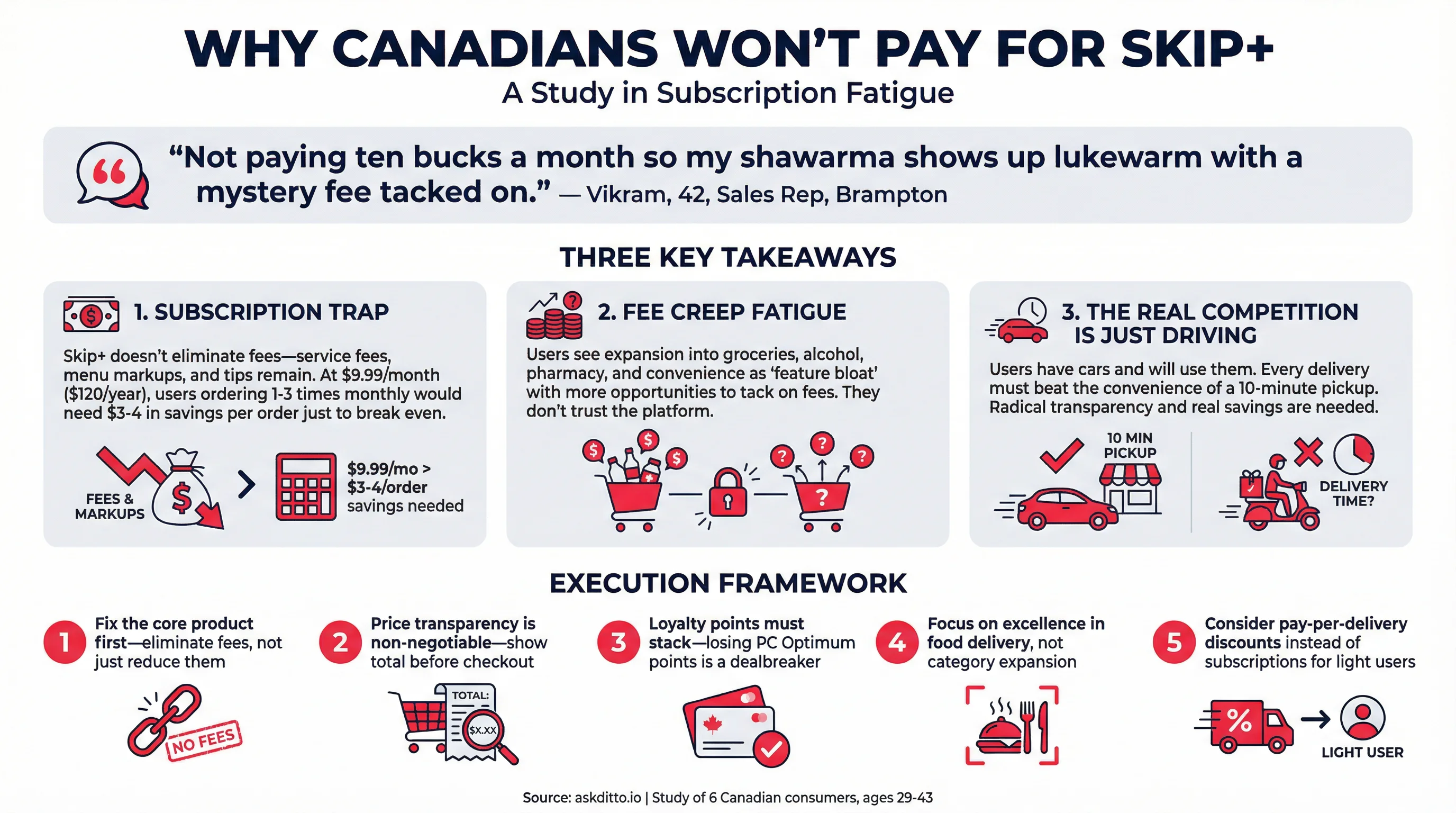

Yet when I asked 6 Canadians whether they would pay $9.99/month for Skip+ (free delivery and reduced fees), every single one said no.

This study reveals why expansion into groceries, alcohol, and pharmacy delivery is not making Skip more appealing. It is making users MORE suspicious. The phrase that kept coming up: "fee creep" and "feature bloat."

The Participants

Six Canadians from across the country: Lethbridge, Vaughan, Hamilton, Oshawa, Brampton, and Windsor. Ages 29-43. Healthcare administrators, account managers, customer success managers, sales reps. All budget-conscious, practical, and deeply skeptical of subscription models.

What unites them: they order food delivery infrequently (1-3 times per month), cook most meals at home, and do mental math on every delivery order comparing app fees to a quick drive.

The Current Landscape: Which App Wins?

The first question was simple: which delivery app do you typically use, and why would you switch?

The market is fragmented. Skip and DoorDash are the most mentioned, with Uber Eats as a backup. But the real insight is that these users are not loyal to any platform. They compare prices at checkout every single time.

Usually Skip or DoorDash, whichever shows the lowest total at checkout after all the junk fees.

Vikram, a 42-year-old sales rep from Brampton, captured the user behaviour perfectly. No loyalty, just math. And if a place answers the phone and is close? He will just pick up.

The switch triggers users mentioned consistently: lower all-in price (not just delivery fee), transparent fees shown upfront, reliable ETAs that do not jump around, no subscription required for free delivery, PC points or real cashback (not app scrip), proof the restaurant and driver are not getting squeezed.

If a place has its own ordering site with curbside, I use that instead and keep the extra fees out of the middleman.

Megan, a 32-year-old customer success manager from Windsor, represents a growing trend: bypassing apps entirely when possible.

Key insight: Users are platform-agnostic price hunters who will abandon any app mid-checkout if the fees feel wrong.

Would You Pay $9.99/Month for Skip+?

The answer was unanimous: no.

Not "maybe in winter." Not "if I ordered more." Just no.

Not paying ten bucks a month so my shawarma shows up lukewarm with a mystery fee tacked on.

Vikram again, cutting to the core issue. The subscription does not actually solve the fee problem. Service fees remain. Menu markups remain. Tip expectations remain. "Free delivery" is lipstick on a pig.

The math problem came up repeatedly. At $9.99/month, that is $120/year. These users order 1-3 times monthly. They would need to see $3-4 in savings per order just to break even. But with markups and remaining fees, the math never works.

If I do 3 to 4 orders in a month, I should come out ahead by more than the sub fee, not break even.

What users actually want from a subscription (if forced to use one):

No junk fees: delivery AND service fee waived. Price parity: app prices match in-restaurant. Automatic credits for late orders without arguing. Easy pause/cancel with no auto-renew tricks. Household sharing for one address. Month-to-month flexibility. Stackable loyalty points. Transparent tipping.

Key insight: Users see Skip+ as a trap, not a benefit. The value proposition is too thin for users who order infrequently.

Does Expansion to Groceries Make Skip More Appealing?

Skip has expanded beyond food delivery into groceries, alcohol, pharmacy, and convenience products. Surely this makes the app more valuable?

Nope. The opposite, actually.

Less appealing, honestly. It feels like feature creep with extra chances to tack on fees.

Vikram (the Brampton sales rep is the voice of this study) articulated what others felt: more categories equals more ways to lose money.

The category-by-category breakdown reveals deep skepticism:

Groceries: "Markup roulette and lousy produce picking. No PC Optimum points is a hard no most days." Users do not trust gig shoppers to pick fresh produce, check expiry dates, or handle substitutions well. And losing loyalty points to order through the app is a dealbreaker.

Alcohol: "The delivery fee plus ID dance is not worth a bottle of wine." Condo buzzers, ID verification at the door, limited selection. Users would rather stop at the LCBO on the way home.

Pharmacy: "I care about privacy and cold-chain; my local already delivers free." Privacy concerns about medication data in an ad profile. Plus, local pharmacies already offer free delivery.

Convenience: "I am not paying a delivery tax on bananas." The markup on convenience items is too obvious. Users refuse to pay premium prices for items they can grab at any corner store.

95% of the time I will just put on boots and be back from No Frills before the app finishes adding fees.

Key insight: Category expansion without fixing the core fee problem just gives users more reasons to be annoyed.

What This Means for Skip and Food Delivery

The research points to a fundamental strategic error. Skip is trying to become an "everything app" when users specifically do not want that.

Actionable takeaways for food delivery companies:

1. Fix the core product first. Users will not pay for a subscription that does not actually eliminate fees. "Reduced" is not good enough.

2. Price transparency is non-negotiable. Show the total cost before checkout. No surprise fees. No small-order surcharges hidden at the end.

3. Loyalty points must stack. Canadians are obsessed with PC Optimum. If using the app means losing points, they will do pickup instead.

4. Category expansion is not a moat. It is just more surface area for fee complaints. Focus on being excellent at food delivery.

5. The subscription model is broken for light users. Consider pay-per-delivery discounts, surge protection, or guaranteed pricing instead.

6. The real competition is "just drive there." These users have cars. They will use them. Every delivery must beat the convenience of a 10-minute pickup.

The Bottom Line

Canadian consumers are not anti-delivery. They are anti-extraction. Every fee, every markup, every upsell attempt pushes them closer to just putting on boots and driving.

Skip's expansion strategy is backfiring. Instead of creating a valuable ecosystem, they are creating a platform that users approach with suspicion, comparing prices at checkout every time, and abandoning orders when the fees stack too high.

The path forward is not more categories. It is radical transparency, real savings, and a subscription that actually delivers value. Until then, Canadians will keep doing the math. And the math says: drive.

Want to understand how your customers think? Ditto lets you run studies like this in hours. Book a demo at askditto.io.

What the Research Revealed

We asked Canadian consumers to share their thoughts. Here is what they told us:

Would you pay $9.99/month for Skip+?

Elliot Sinclair, 43, Healthcare Admin, Lethbridge, AB:

Short answer: No. I cook, we do takeout maybe once a month, and subscriptions are a slow leak. At 10 bucks a month I'd have to be ordering a lot more, and around Lethbridge the selection and ETAs feel too hit or miss to prepay for privilege.

Daniel Patel, 38, Healthcare Worker, Vaughan, ON:

Short answer: No. Another subscription? Hard pass. I cook most nights. I order maybe twice a month. That is $120 a year. That is a solid grocery run. Free delivery is not free. You still get service fees, menu markup, tip. So the math is bad for me.

Michael Carter, 42, Account Manager, Hamilton, ON:

Short answer: no, I would not pay for it right now. I cook most nights, batch on Sundays, and if I cave to takeout it is maybe 1-2 times a month. At $9.99, I would need roughly 3 orders a month just to break even on the delivery fee while still eating $6-10 in other add-ons.