If you've searched "Simile AI pricing" and landed here, I'll save you some time: Simile doesn't publish its prices. There's no pricing page. There's no "plans" dropdown. There is a "Request Demo" button and a great deal of white space. For a platform that promises "instant insights," learning what it costs is anything but instant.

This is standard practice for enterprise software, of course. It's also deeply frustrating for anyone trying to build a business case, compare options, or simply work out whether Simile fits their budget before investing time in a sales conversation.

So I've done the detective work. Using Simile's public customer list, funding data, market comparisons, and industry pricing benchmarks, here's what we can reasonably infer about what Simile costs, and how it compares to alternatives that actually publish their numbers.

What We Know About Simile's Pricing

The Evidence

Let's start with what's publicly available:

Funding: $100 million Series A from Index Ventures, Bain Capital Ventures, and Hanabi Capital. This is the largest funding round in the synthetic research space. Companies raising $100M aren't building self-serve products at $49/month.

Known customers: CVS Health (9,000+ US stores), Wealthfront (digital wealth management), Telstra (Australia's largest telco), Suntory Beverages & Food (global drinks conglomerate), Banco Itau (Latin America's largest bank), Garnett Station Partners (PE firm). These are organisations with seven-figure research budgets.

Access model: Demo-only. No self-serve signup, no free trial, no published plans. The sales-gated model typically indicates minimum contract values that justify the cost of a sales team.

Website: Marked noindex/nofollow. No blog content, no public documentation, no case studies beyond logos. This level of opacity is consistent with enterprise software that sells on relationships rather than marketing.

The Estimate

Based on these signals, industry benchmarks, and conversations with others in the market, Simile's pricing is almost certainly in the $100,000 to $250,000+ per year range. Here's the reasoning:

Floor estimate ($100,000/year): The minimum price point that justifies a sales-gated enterprise model with demo conversations. Below this, companies typically offer self-serve access because the sales cost per customer becomes prohibitive.

Mid estimate ($150,000-$200,000/year): Consistent with Simile's customer profile. CVS, Telstra, and Banco Itau are organisations where a $150K research tool is a rounding error on their annual insights budget.

Ceiling estimate ($250,000+/year): Possible for enterprise agreements that include custom model training, dedicated support, integration work, or volume-based pricing tiers.

These are educated guesses, not confirmed figures. Simile may well offer different pricing tiers, usage-based components, or pilot programmes at lower entry points. Without their cooperation, we're reading tea leaves. But the tea leaves are fairly consistent.

How Simile's Pricing Compares to the Market

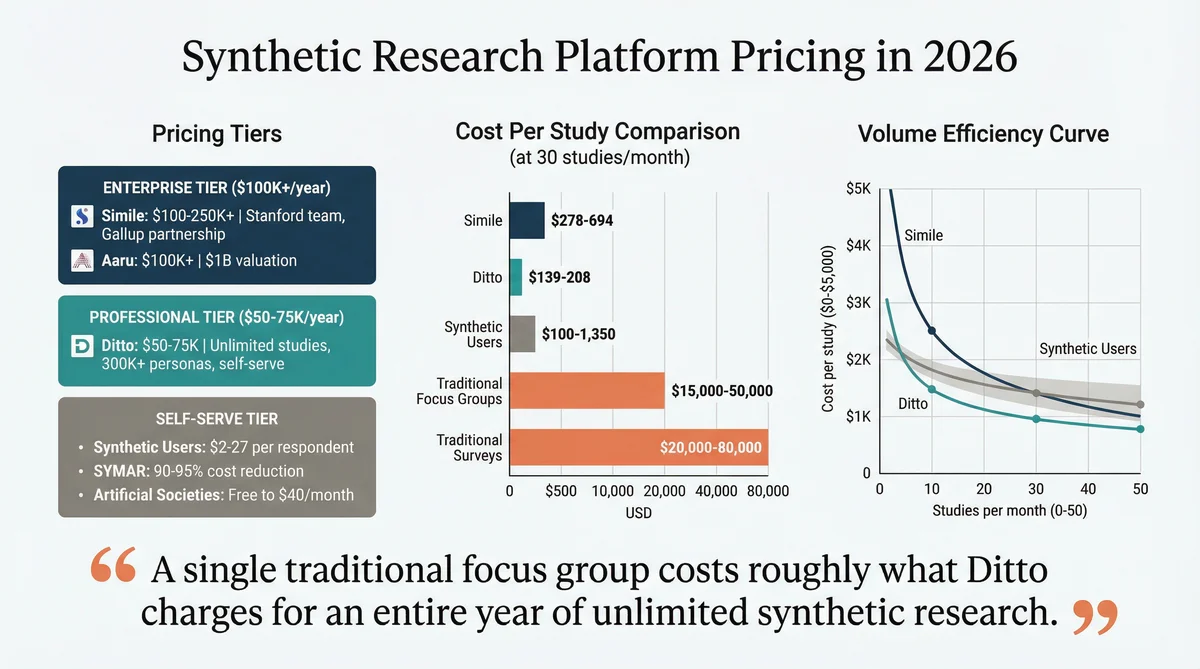

The synthetic research market spans an enormous price range. Here's how the major platforms stack up:

Enterprise Tier ($100,000+/year)

Simile: $100,000-$250,000+/year (estimated). Interview-trained generative agents, Gallup partnership, enterprise-only access.

Aaru: $100,000+/year (estimated). $1B valuation, EY partnership, financial/consulting focus. Also enterprise-only.

Professional Tier ($50,000-$100,000/year)

Ditto: $50,000-$75,000/year. Unlimited studies, 300,000+ personas, 50+ countries, Figma/Canva/Framer integrations, self-serve access. 92% validation across 50+ studies.

Mid-Market Tier ($10,000-$50,000/year)

Quantilope: $22,000+/year. Automated consumer insights with both traditional and AI-enhanced survey capabilities.

SYMAR: Budget-friendly synthetic surveys and focus groups. EU-compliant, academic partnerships, 90-95% cost reduction claims.

Self-Serve Tier (Under $10,000/year)

Synthetic Users: $2-$27 per synthetic respondent. Pay-as-you-go. At 50 respondents per study and 10 studies per month, annual cost: roughly $12,000-$162,000 depending on persona complexity.

Artificial Societies: Free tier available, paid plans from $40/month. Basic synthetic survey tool for individual researchers.

The Cost Per Study Calculation

Annual pricing is one thing. The number that actually matters for ROI is cost per study. Here's how the economics work at different usage levels:

At 10 studies per month (120/year)

Simile: $833-$2,083 per study (at $100K-$250K/year)

Ditto: $417-$625 per study (at $50K-$75K/year)

Synthetic Users: $100-$1,350 per study (at 50 respondents, $2-$27 each)

At 30 studies per month (360/year)

Simile: $278-$694 per study

Ditto: $139-$208 per study

Synthetic Users: $100-$1,350 per study (same; per-respondent pricing doesn't scale)

At 50 studies per month (600/year)

Simile: $167-$417 per study

Ditto: $83-$125 per study

Synthetic Users: $100-$1,350 per study

The pattern is clear: unlimited-study platforms (Ditto) get cheaper per study as usage increases, while per-respondent platforms (Synthetic Users) have flat economics. Enterprise platforms (Simile, Aaru) sit in between, likely with negotiable volume discounts that improve at higher usage but rarely match unlimited pricing.

All of This Is Cheaper Than Traditional Research

Before you wince at any of these numbers, context matters. Traditional market research projects typically cost:

Focus groups: $15,000-$50,000 per project. Includes recruitment, facilities, moderation, and analysis. Timeline: 4-8 weeks.

Quantitative surveys: $20,000-$80,000 per project. Panel recruitment, programming, fieldwork, and reporting. Timeline: 3-6 weeks.

Ethnographic research: $30,000-$100,000+ per project. Immersive, longitudinal, labour-intensive. Timeline: 8-16 weeks.

Full brand tracking: $100,000-$500,000/year. Continuous tracking with quarterly reporting. Timeline: ongoing.

A single traditional focus group project costs roughly what Ditto charges for an entire year of unlimited synthetic research. Even Simile's estimated pricing is competitive with two or three traditional projects per year. The value proposition of synthetic research isn't that it's cheap in absolute terms. It's that it's dramatically cheaper and faster per insight than anything that existed before.

What Should You Actually Spend?

The right budget depends on three things:

How often do you need research? If you run fewer than 5 studies per month, pay-per-respondent pricing (Synthetic Users) may be most efficient. Above 5 studies/month, unlimited platforms (Ditto) deliver better economics. Above 20 studies/month, the per-study cost on unlimited platforms becomes compelling enough to justify the annual commitment.

How much do you currently spend on traditional research? If your annual research budget is under $50,000, synthetic platforms offer an opportunity to dramatically increase your research volume. If it's above $200,000, replacing even a fraction of traditional projects with synthetic research could free up significant budget.

How important is immediate access? If you need answers this week, self-serve platforms (Ditto, Synthetic Users) are your only realistic option. If you can wait 4-8 weeks for an enterprise sales process, the full range is available.

A Practical Starting Point

If you're exploring synthetic research for the first time, here's what I'd suggest:

Run 5-10 studies on a self-serve platform. Use Ditto or Synthetic Users to test whether synthetic research produces useful results for your specific questions. Cost: $50-$500.

Compare with existing research. If you have traditional research data on the same topics, compare the synthetic findings. How closely do they align?

Build the business case. If the outputs are useful, calculate the ROI of replacing X traditional projects with Y synthetic studies per month. The numbers usually speak for themselves.

Scale up. Choose the platform that best fits your volume, budget, and use case. Commit to an annual plan when you're confident in the value.

The Bottom Line

Simile is a premium product at a premium price, designed for enterprise organisations with established research budgets. If that's you, and if Simile's unique capabilities (interview-trained agents, Gallup partnership, emergent behaviour simulation) align with your research needs, the pricing is likely justifiable.

But if you're looking for the best value in synthetic research, platforms with transparent pricing and self-serve access deliver more research per pound spent. Ditto at $50-$75K/year with unlimited studies offers the strongest economics for teams running frequent research. Synthetic Users offers the lowest barrier to entry for occasional studies.

The most expensive option in synthetic research is still dramatically cheaper than traditional alternatives. But within the synthetic market itself, there's a 50x price difference between the cheapest and most expensive options. Choose based on your research volume, required capabilities, and willingness to commit to an annual contract.

Phillip Gales is co-founder at Ditto. Pricing estimates for Simile and other platforms are based on public information and industry benchmarks. Readers should verify current pricing directly with each vendor.