Simile's $100 million funding announcement on 12th February 2026 put synthetic market research squarely on the radar of every brand strategist, product manager, and research director with a budget to defend. But here's the thing: Simile isn't the only game in town. It isn't even the first.

The synthetic research market has been building quietly for the past two years, and several platforms now offer compelling alternatives to Simile's enterprise-only, demo-required model. Some are cheaper. Some are more accessible. Some have published more extensive validation data. A few offer capabilities that Simile doesn't.

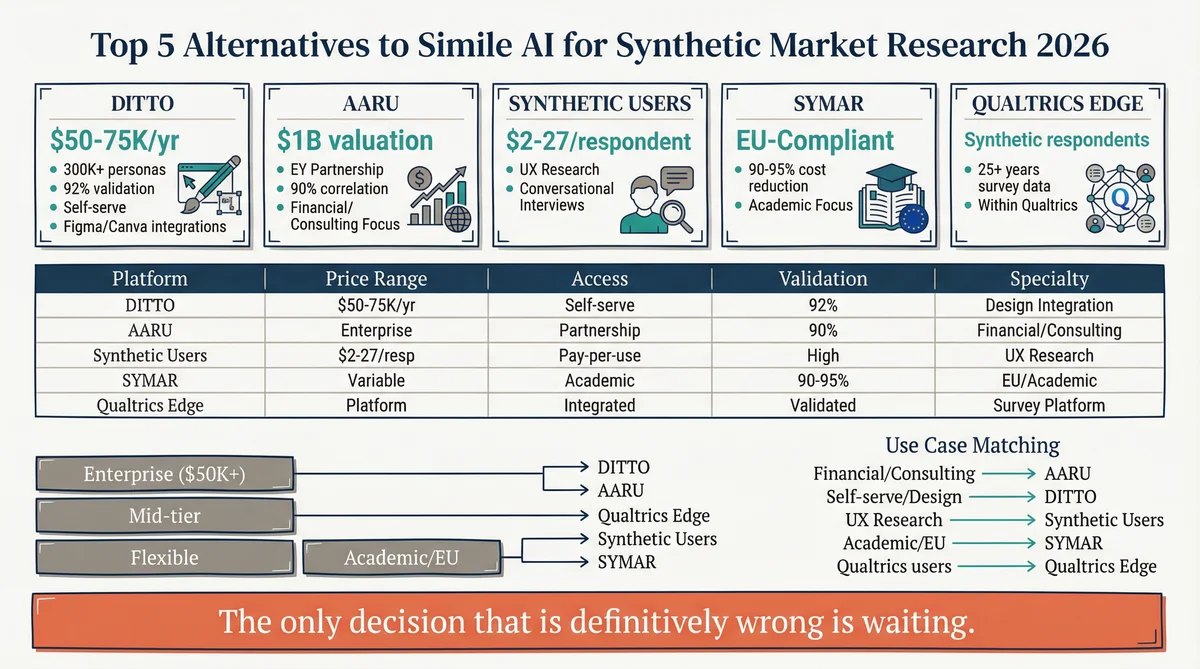

Whether you've been priced out of Simile's enterprise tier, frustrated by the lack of self-serve access, or simply want to understand what else is available before committing, here are the five platforms worth evaluating in 2026.

1. Ditto

Best for: Brand teams, product managers, and agencies that need immediate access to synthetic research with global coverage and design tool integrations.

Ditto is arguably the most direct alternative to Simile for mainstream synthetic research. The platform offers 300,000+ pre-built personas grounded in census data and behavioural patterns across 50+ countries. Where Simile trains individual agents on individual interviews, Ditto calibrates personas against population-level distributions to ensure panels mirror real-world demographics.

What Makes Ditto Different

Self-serve access: Create an account and run your first study immediately. No demo request, no sales call, no enterprise contract. This is the single biggest practical difference from Simile.

92% validation: Published overlap with traditional focus groups across 50+ parallel validation studies. This is the broadest validation dataset any synthetic research platform has made public.

Design integrations: Figma, Canva, and Framer plugins let product teams test designs, landing pages, and creative assets directly within their existing workflow. Test a Figma prototype with 100 synthetic users without leaving the design tool.

Global persona coverage: 50+ countries with demographic, psychographic, and behavioural filters. Run a study in Nigeria, Japan, Germany, and Brazil simultaneously.

Unlimited studies: Flat annual pricing ($50,000-$75,000/year) with no per-study or per-respondent charges. The more you use it, the cheaper each study becomes.

Limitations

Personas are population-grounded rather than interview-trained, which means less individual-level depth than Simile's agent architecture

No equivalent to Simile's Gallup partnership for probability-based panel representativeness

Not designed for complex multi-agent behavioural simulation (Simile's "Smallville" capability)

Pricing

$50,000-$75,000/year with unlimited studies. Transparent pricing available on request. Roughly 50-75% less than Simile's estimated enterprise pricing.

Disclosure: I'm a co-founder at Ditto. I've placed it first because it's the platform I know best and believe is the strongest all-round alternative, but you should evaluate all five options for your specific needs.

2. Aaru

Best for: Enterprise organisations, consulting firms, and financial institutions that need highly scalable synthetic research with strong institutional validation.

Aaru is the other heavyweight in synthetic research, having reportedly raised at a $1 billion headline valuation in December 2025 led by Redpoint Ventures. If Simile is the Stanford candidate, Aaru is the McKinsey candidate: deeply embedded in enterprise consulting and financial services workflows.

What Makes Aaru Different

EY validation: EY recreated their annual Global Wealth Research Report using Aaru in a single day, achieving 90% median correlation with the original six-month, multi-country study. This is one of the most compelling real-world validation stories in the market.

Political prediction: Aaru predicted the outcome of the New York Democratic primary, demonstrating capabilities beyond traditional market research into public opinion forecasting.

Enterprise scale: Built for organisations that need to run thousands of synthetic interviews simultaneously, with infrastructure designed for consulting-grade throughput.

Sector-specific models: Strong positioning in financial services, wealth management, and professional services, with published case studies from major consulting firms.

Limitations

Also enterprise-focused with limited self-serve access

Less public documentation about the underlying technology compared to Simile's published papers

Primary strength in financial/consulting verticals may limit applicability for CPG, retail, or consumer tech brands

Pricing

Enterprise-only. Not publicly available. At a $1 billion valuation, expect pricing comparable to or exceeding Simile's estimated $100,000+/year.

3. Synthetic Users

Best for: UX researchers, product designers, and startup teams that need quick, affordable concept testing with open-ended persona conversations.

Synthetic Users takes a fundamentally different approach from the enterprise platforms. Rather than simulating broad populations, it focuses on creating detailed individual synthetic personas for UX research conversations. Think of it as a synthetic user interview tool rather than a synthetic survey platform.

What Makes Synthetic Users Different

Conversational interface: Each synthetic user can engage in open-ended conversations, not just answer structured survey questions. You can probe, follow up, and explore unexpected tangents, much like a real user interview.

Per-respondent pricing: $2-$27 per synthetic user depending on persona complexity and conversation depth. This makes it accessible for one-off studies without annual commitments.

UX-native workflow: Purpose-built for product and design teams. Upload a prototype, describe a task, and get synthetic user feedback on the experience.

Rapid iteration: Test multiple concept variations in minutes. Change a headline, re-run the study, see how responses shift. The speed enables experimentation that traditional research can't support.

Limitations

Per-respondent pricing becomes expensive at scale (100 respondents at $27 each = $2,700 per study)

Less rigorous population calibration than Ditto or Simile; personas are generated rather than grounded

Focused on UX research; less suitable for brand positioning, market sizing, or attitudinal studies

Limited published validation against traditional research methods

Pricing

$2-$27 per synthetic respondent. Pay-as-you-go model. Best value for occasional studies or teams exploring synthetic research for the first time.

4. SYMAR (Formerly OpinioAI)

Best for: Academic researchers, European organisations, and budget-conscious teams that need synthetic surveys and focus groups at dramatic cost reductions.

SYMAR, which recently rebranded from OpinioAI, is a Czech Republic-based platform that offers synthetic surveys and focus groups with a strong emphasis on cost reduction. The platform positions itself as delivering 90-95% cost savings versus traditional methods, making it one of the most aggressively priced options in the market.

What Makes SYMAR Different

European compliance: Built in the EU with GDPR compliance as a foundational requirement. For European organisations concerned about data sovereignty, this matters.

Academic partnerships: Strong relationships with European research institutions. Published papers on synthetic respondent methodology and validation approaches.

Survey + focus group modes: Supports both structured quantitative surveys and open-ended qualitative focus group simulations in a single platform.

Cost positioning: Claims 90-95% cost reduction versus traditional methods, making it potentially the cheapest way to experiment with synthetic research at scale.

Limitations

Smaller company with less funding than Simile, Aaru, or Ditto

Strongest in European markets; less developed global coverage compared to Ditto's 50+ countries

Less published validation data than Ditto or Simile

Rebranding from OpinioAI to SYMAR may cause confusion in the market

Pricing

Significantly lower than enterprise platforms. Specific pricing not consistently published but positioned as budget-friendly for academic and mid-market users.

5. Qualtrics Edge Audiences

Best for: Existing Qualtrics customers, large enterprise research teams, and organisations that want synthetic research integrated into their established survey infrastructure.

Qualtrics Edge Audiences represents the establishment's answer to synthetic research. Rather than building a standalone platform, Qualtrics has embedded "scientifically validated synthetic respondents" directly into the world's most widely used survey platform. If your organisation already uses Qualtrics, synthetic research becomes a toggle rather than a new vendor relationship.

What Makes Qualtrics Edge Different

Platform integration: Synthetic respondents are available directly within the Qualtrics survey builder. No new tool to learn, no new vendor to onboard, no new data format to interpret.

25+ years of research data: Qualtrics claims its synthetic respondents are backed by decades of accumulated survey data, potentially the largest training dataset in the industry.

Existing enterprise relationships: If your organisation already pays for Qualtrics, adding synthetic respondents may be a contract amendment rather than a new procurement process.

Hybrid methodology: Easy to run the same survey with both synthetic and real respondents for direct comparison and validation within a single platform.

Limitations

Requires existing Qualtrics subscription; not a standalone synthetic research tool

Less flexibility than purpose-built platforms; synthetic respondents operate within Qualtrics' survey paradigm

Limited to survey-based research; no conversational interviews, behavioural simulation, or design testing

Qualtrics' synthetic methodology is less transparent than Simile's published papers or Ditto's validation programme

Pricing

Add-on to existing Qualtrics subscription. Pricing varies by contract but is likely competitive for existing customers. Standalone access is not available.

How to Choose: A Decision Framework

The right platform depends on three variables: your budget, your use case, and how quickly you need to start.

Start here if your budget is...

Under $10,000/year: Synthetic Users (pay-per-respondent) or SYMAR (budget-friendly plans)

$50,000-$75,000/year: Ditto (unlimited studies, self-serve, global coverage)

$100,000+/year: Simile, Aaru, or Qualtrics Edge (enterprise platforms with premium capabilities)

Start here if your primary use case is...

UX research and concept testing: Synthetic Users or Ditto (with Figma/Canva integrations)

Brand and consumer research: Ditto (broadest validation) or Simile (deepest agent depth)

Financial/consulting analysis: Aaru (EY validation, sector expertise)

Survey augmentation: Qualtrics Edge (if you're already on Qualtrics)

Academic research: SYMAR (European compliance, academic partnerships) or Simile (peer-reviewed methodology)

Behavioural simulation: Simile (only platform with emergent behaviour capabilities)

Start here if you need to run research...

Today: Ditto or Synthetic Users (self-serve, immediate access)

This quarter: Simile, Aaru, or Qualtrics Edge (enterprise sales process required)

The Bottom Line

Simile is an important company with genuinely novel technology, but its enterprise-only model means it's not the right starting point for most organisations exploring synthetic research. The alternatives listed here offer different combinations of accessibility, price, validation, and specialisation that may better suit your needs.

The synthetic research market is growing fast. Qualtrics projects that 71% of market researchers expect synthetic responses to dominate within three years. The smartest move isn't to pick one platform and hope for the best. It's to start experimenting now, build institutional knowledge about what synthetic research can and can't do for your specific questions, and scale your investment as the technology matures.

Every platform on this list offers a faster, cheaper starting point than commissioning a traditional research project. The only decision that's definitively wrong is waiting.

Phillip Gales is co-founder at Ditto, one of the platforms reviewed in this article. He has tried to represent all platforms fairly but acknowledges his obvious interest. Readers should evaluate each platform independently.