Two platforms. Both claim to simulate human behaviour. Both promise to replace traditional focus groups with AI-generated insights in minutes rather than weeks. But the similarities end roughly there.

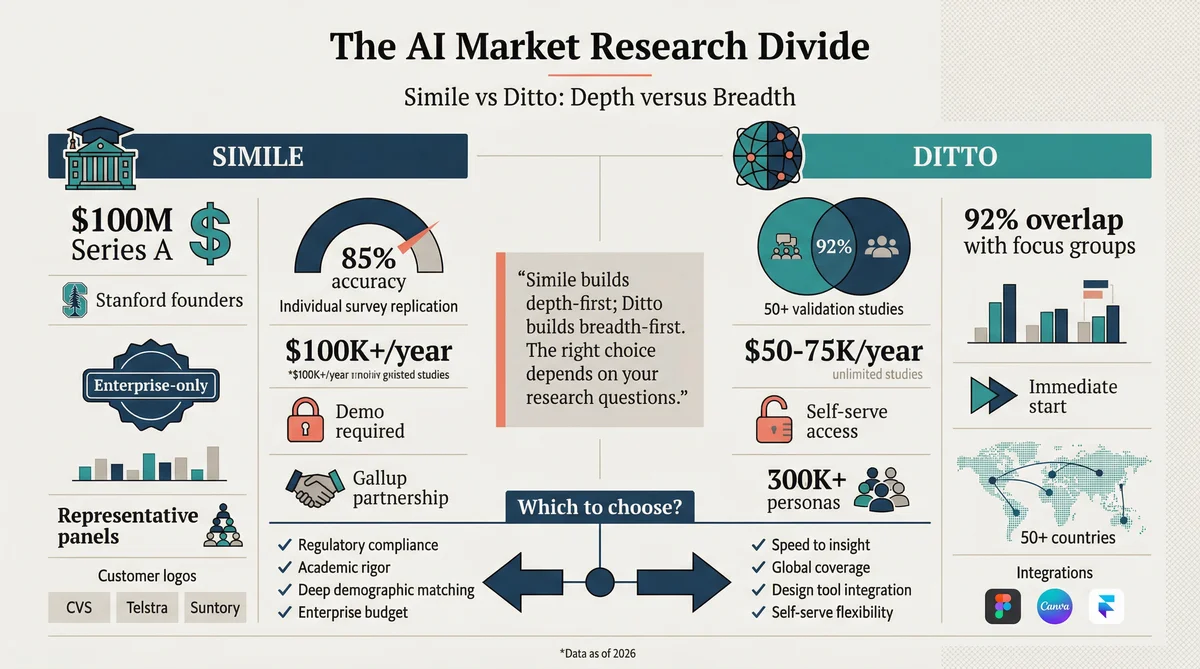

Simile, which emerged from stealth on 12th February 2026 with $100 million in Series A funding, is the Stanford-bred flagship of the generative agents movement. Ditto has been quietly building in the synthetic research space with a different philosophy: population-grounded personas, self-serve access, and published validation data showing 92% overlap with traditional focus groups across 50+ parallel studies.

If you're evaluating both platforms, the decision ultimately comes down to what you need, how much you want to spend, and how quickly you need to start. This comparison is designed to help you make that decision with your eyes open.

Full disclosure: I'm a co-founder at Ditto. I've tried to make this comparison as fair and evidence-based as possible, but you should factor that in. Where I'm stating facts, I'll cite sources. Where I'm editorialising, I'll make that clear.

The Core Technology

Simile's Approach: Interview-Trained Generative Agents

Simile's technology originates from two landmark Stanford papers. The 2023 "Generative Agents" paper created 25 AI agents in a virtual town that autonomously formed relationships, planned activities, and exhibited emergent social behaviour. The 2024 follow-up, "Generative Agent Simulations of 1,000 People," trained agents on qualitative interviews with 1,052 real individuals.

The core architectural innovation is a three-layer system: memory (agents retain and recall past experiences), reflection (agents synthesise observations into higher-level insights), and planning (agents generate multi-step action plans). This produces agents that don't just answer questions but simulate decision-making processes.

Published accuracy: agents replicated participants' General Social Survey responses at 85% of human self-replication accuracy (the rate at which real people reproduce their own answers two weeks later).

Ditto's Approach: Population-Grounded Synthetic Personas

Ditto takes a different route. Rather than training individual agents on individual interviews, Ditto builds synthetic personas grounded in population-level data: census demographics, consumer behaviour patterns, attitudinal surveys, and regional preference data. Each persona is calibrated against real-world distributions to ensure the synthetic panel mirrors the actual population.

The model supports over 300,000 pre-built personas across 50+ countries, with demographic filters including age, income, location, occupation, and psychographic segments. Users can recruit custom panels for specific research needs or use existing population groups.

Published accuracy: 92% overlap with traditional focus group findings across 50+ parallel validation studies comparing synthetic and human panels on the same research questions.

The philosophical difference is significant. Simile builds depth-first (rich individual agents based on real interviews), Ditto builds breadth-first (many personas calibrated to population distributions). Both approaches have trade-offs, and the right choice depends on your research needs.

Feature-by-Feature Comparison

Access Model

Simile: Demo-only. No self-serve access. Sales conversation required.

Ditto: Self-serve platform. Create an account and run your first study immediately.

Pricing

Simile: Not published. Enterprise-only. Estimated $100,000+/year based on customer profile (CVS, Telstra, Banco Itau).

Ditto: $50,000-$75,000/year with unlimited studies. Transparent pricing available on request.

Validation

Simile: 85% of human self-replication accuracy on General Social Survey (peer-reviewed, 1,052 participants).

Ditto: 92% overlap with traditional focus groups across 50+ parallel studies (proprietary validation programme).

Persona Pool

Simile: Size not disclosed. Agents are trained on individual interviews. Gallup partnership promises nationally representative panels.

Ditto: 300,000+ pre-built personas across 50+ countries. Custom recruitment available for niche audiences.

Speed

Simile: Not disclosed publicly. Their website promises "instant insights" but no specific benchmarks.

Ditto: Studies complete in 5-15 minutes. Full research report generated automatically upon completion.

Integrations

Simile: Not disclosed. Enterprise API likely available for large customers.

Ditto: Figma, Canva, and Framer integrations for in-tool design feedback. Full API for custom workflows.

Target User

Simile: Enterprise research teams, Fortune 500 companies, organisations with established research budgets and processes.

Ditto: Brand founders, product managers, growth teams, agencies, and enterprise research teams. Designed for self-serve use by non-researchers.

Where Simile Has the Edge

Credit where it's due. There are areas where Simile's approach offers genuine advantages:

Academic credibility: Simile was founded by the researchers who invented generative agents. Their validation is peer-reviewed and published. Backed by Fei-Fei Li and Andrej Karpathy. For organisations where academic credibility matters (regulated industries, academic partnerships), this carries significant weight.

Individual agent depth: Because Simile's agents are trained on real interviews with real individuals, they can (in theory) simulate deeper, more nuanced individual-level behaviour. If your research requires understanding a specific person's decision-making process rather than population-level patterns, this architecture has advantages.

The Gallup partnership: If Simile delivers probability-based synthetic panels through Gallup, this would be a genuinely differentiated capability. Gallup's methodological credibility is unmatched in the polling industry.

Behavioural simulation beyond surveys: Simile's "Smallville" origins mean the architecture supports emergent behaviour, not just question-and-answer responses. For use cases like simulating employee dynamics, organisational change, or multi-agent market scenarios, this is uniquely powerful.

Where Ditto Has the Edge

Immediate access: You can create an account and run your first study today. No sales call, no demo request, no enterprise contract negotiation. For teams that need answers this week rather than this quarter, this matters enormously.

Published validation at scale: 92% overlap across 50+ parallel studies is a larger validation dataset than any other synthetic research platform has published, including Simile. The breadth of validation (multiple industries, geographies, and research types) provides more confidence for diverse use cases.

Global coverage: 300,000+ personas across 50+ countries means you can run research in markets where recruiting real participants is expensive, slow, or practically impossible. Simile's geographic coverage is not publicly documented.

Design tool integrations: Figma, Canva, and Framer integrations let product teams test designs, landing pages, and creative assets directly within their existing workflow. This is a capability Simile doesn't appear to offer.

Price-to-value ratio: At roughly half the estimated cost of Simile, with unlimited studies and self-serve access, Ditto delivers more research volume per pound spent. For organisations running frequent studies, this compounds quickly.

Transparency: Published pricing, published validation data, public documentation, active blog content. You can evaluate Ditto thoroughly before speaking to anyone. Simile's website is marked noindex/nofollow with no blog, no documentation, and no public case studies beyond customer logos.

Which Platform for Which Use Case?

Choose Simile if you:

Are a Fortune 500 company with an established research budget exceeding $100,000/year

Need academic-grade validation for regulated or compliance-sensitive research

Want to simulate complex multi-agent behavioural scenarios (not just surveys)

Require Gallup-grade panel representativeness (when the partnership delivers)

Have the time and resources for an enterprise sales and implementation process

Choose Ditto if you:

Need to start running research immediately without a sales process

Run frequent studies across multiple brands, products, or markets

Want to test designs, landing pages, and creative assets within Figma, Canva, or Framer

Operate across multiple countries and need global persona coverage

Are a startup, mid-market brand, or agency where research budget efficiency matters

Prefer transparent pricing and published validation data before committing

Consider both (or neither) if you:

Are evaluating synthetic research for the first time and want to compare approaches

Have research needs that span both enterprise-grade behavioural simulation and rapid-fire product testing

Want to validate synthetic findings against traditional research before fully committing to either platform

The Validation Question

Both platforms publish accuracy metrics, but they're measuring different things. Simile's 85% figure measures how well AI agents reproduce individual-level survey responses compared to real individuals retaking the same survey. Ditto's 92% measures the overlap between synthetic panel findings and traditional focus group findings at the aggregate level.

These are not directly comparable numbers. Individual-level replication (Simile) is a harder task than aggregate-level agreement (Ditto). But aggregate-level agreement is typically what businesses actually care about: "Will our target market prefer option A or option B?" rather than "Will this specific person prefer option A?"

The honest answer is that both platforms are working with relatively early validation evidence. Simile's is peer-reviewed but limited to attitudinal surveys. Ditto's is broader in scope but proprietary. Neither platform can yet point to a large body of published, independent, third-party validation across diverse commercial use cases.

This isn't a criticism of either platform specifically. It's the state of the entire synthetic research market. The technology is ahead of the evidence base. Early adopters are effectively participating in the validation process, which is either exciting or concerning depending on your risk tolerance.

Pricing Reality

Traditional market research projects typically cost $20,000-$50,000 and take 4-8 weeks. Both Simile and Ditto represent dramatic improvements on this baseline, but at very different price points:

Simile: Enterprise pricing, not published. Based on customer profile and funding level, estimated $100,000-$250,000/year. The sales-only access model suggests significant minimum contract values.

Ditto: $50,000-$75,000/year with unlimited studies. This means the per-study cost decreases as you run more research, making it particularly attractive for teams that run 10+ studies per month.

For a mid-market brand running 20 studies per month, Ditto's cost per study works out to roughly $200-$300. With Simile, assuming a $150,000 annual contract, that same volume would cost $625 per study. The gap widens further at higher volumes.

Neither platform is cheap. But both are dramatically less expensive than traditional alternatives, and both deliver results in minutes rather than weeks. The question is whether the additional capabilities Simile offers justify the premium for your specific use case.

The Bottom Line

Simile and Ditto are building towards the same future from different directions. Simile is taking the academic, depth-first, enterprise-only approach: world-class technology, world-class team, world-class pricing. Ditto is taking the practical, breadth-first, accessibility approach: strong validation, global coverage, immediate access, and transparent economics.

If I weren't a co-founder at Ditto, here's what I'd tell you: try Ditto first, because you can. Run a study this afternoon. See if the outputs are useful for your specific research questions. If they are, you've found your platform at a sensible price. If you need capabilities that Ditto doesn't offer, particularly deep individual-level simulation or Gallup-grade representativeness, then invest the time in Simile's enterprise sales process.

The worst decision is no decision. Synthetic research is here, the technology works, and the organisations that start building institutional knowledge now will have a significant advantage over those who wait for the field to "mature." It's already maturing. Quite quickly, in fact.

Phillip Gales is co-founder at Ditto. He has tried to make this comparison fair but acknowledges his obvious bias. Readers are encouraged to evaluate both platforms independently.