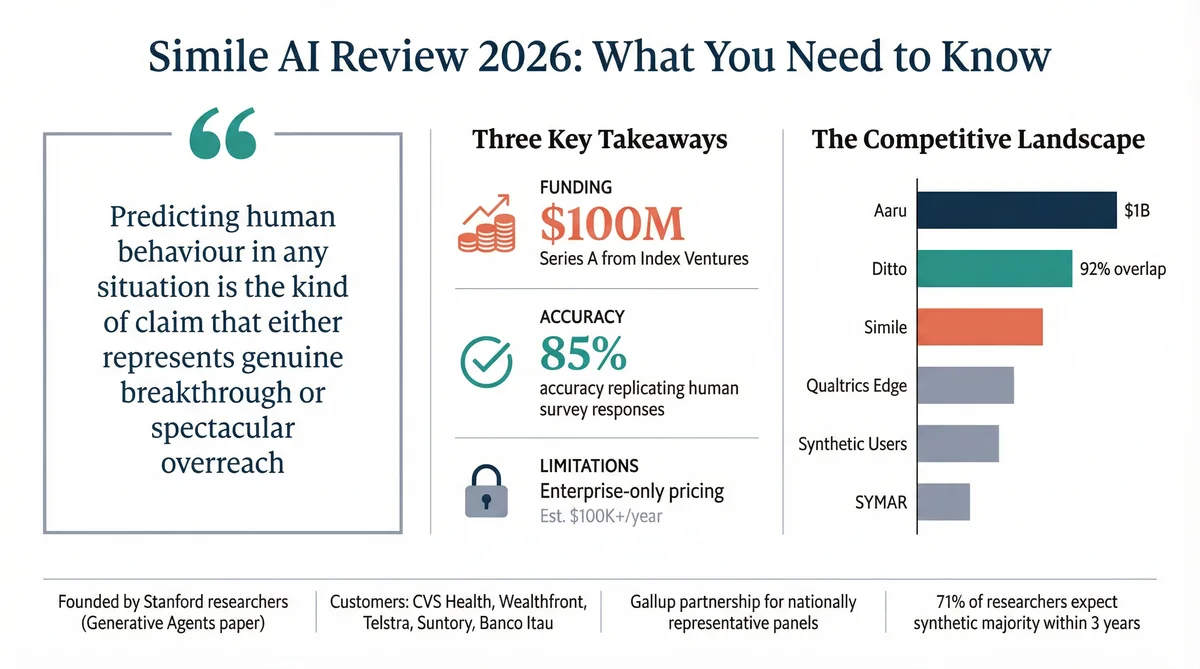

One hundred million dollars. That's what it costs, apparently, to turn a Stanford research paper into a product that predicts what you'll buy next. Simile, the behavioural simulation startup founded by the team behind the famous "Generative Agents" research, emerged from stealth on 12th February 2026 with a Series A that makes most seed rounds look like loose change.

The pitch is striking: AI agents that don't just mimic human conversation but simulate genuine human behaviour, complete with memories, preferences, and decision-making patterns drawn from real interviews with real people. CVS Health is already using it to decide which products to stock. The founding team includes three Stanford professors and a former early-stage investor who helped scale Hebbia's revenue 15x before it was cool.

But here's the question that $100 million in venture capital doesn't automatically answer: is Simile genuinely a new category, or is it a very well-credentialled entry into an increasingly crowded field of synthetic research platforms? I've spent the past week pulling apart everything publicly available about the product, the team, the technology, and the competitive landscape. Here's what I found.

What Simile Actually Does

Simile describes itself as "a simulation platform for human behaviour." The core proposition is that organisations can test how customers, employees, and populations will respond to changes before making those changes in the real world. Think of it as a flight simulator for business decisions.

The platform offers six primary capabilities, according to their website:

Find your audience: Understand customers faster and act sooner

Reach niche populations: Unlock insights from hard-to-engage groups

De-risk decisions: Catch critical feedback before costly launches

Understand segments: Segment sentiment with precision and scale

Test concepts: Validate design choices with real-world behaviour

Generate instant insights: Go from analysis to output instantly

The language is deliberately broad. Simile is positioning not as a market research tool but as a general-purpose behavioural prediction platform. Their stated ambition: "a foundation model that predicts human behaviour in any situation."

This is both the most interesting and the most concerning thing about Simile. "Predicting human behaviour in any situation" is the kind of claim that either represents genuine breakthrough or spectacular overreach. The answer, predictably, is somewhere between the two.

The Technology: From Smallville to $100M

To understand Simile, you need to understand two research papers. The first, published in April 2023 by Joon Sung Park, Joseph O'Brien, Carrie Cai, Meredith Ringel Morris, Percy Liang, and Michael Bernstein, introduced "generative agents" to the world. The researchers created 25 AI agents and placed them in a virtual town called Smallville, loosely inspired by The Sims.

What happened next was genuinely remarkable. Given only a single directive that one agent wanted to throw a Valentine's Day party, the agents autonomously spread invitations, formed new relationships, asked each other on dates, and collectively showed up at the right time. They weren't programmed to do any of this. The behaviours emerged from an architecture that gave agents memory, reflection, and planning capabilities.

The second paper, published in November 2024, scaled the approach dramatically. "Generative Agent Simulations of 1,000 People" described an architecture trained on qualitative interviews with 1,052 real individuals about their lives. The resulting AI agents replicated participants' responses on the General Social Survey with 85% of the accuracy that participants achieved when retaking the survey themselves two weeks later.

That 85% figure is the scientific foundation upon which Simile's commercial proposition rests. It's impressive. It's also worth noting what it means and what it doesn't. It means the agents can broadly reproduce attitudinal responses on a standardised survey. It does not necessarily mean they can predict specific purchasing decisions, emotional reactions to novel products, or behaviour under conditions that differ significantly from the training interviews.

The Founding Team

The team is, by any measure, extraordinary:

Joon Sung Park created the Generative Agents paper that started it all. Computer science PhD from Stanford, now on leave to build Simile. He literally invented the field.

Michael Bernstein is a Stanford CS professor, Bass University Fellow, and senior fellow at the Stanford Institute for Human-Centered AI. He contributed to the ImageNet Large Scale Visual Recognition Challenge paper. Sloan Fellow. Computer History Museum prize winner. Also on leave from Stanford.

Percy Liang directs the Stanford Center for Research on Foundation Models (CRFM) and created the HELM benchmarks that are now the standard for evaluating language models. Presidential Early Career Award recipient.

Lainie Yallen brings the commercial muscle. Employee #8 at Hebbia (helped scale revenue 15x), co-founded TriplePlay (acquired by Roblox in 2022), and spent three years as an early-stage tech investor.

The investor list is equally formidable: Index Ventures led the round, with Bain Capital Ventures and Hanabi Capital participating. Fei-Fei Li and Andrej Karpathy are personal backers. When the people who built ImageNet and Tesla's autopilot invest in your company, the technical credibility argument is essentially settled.

Who's Using Simile?

Simile's website displays logos from six organisations: CVS Health, Wealthfront, Telstra, Suntory Beverages & Food, Banco Itau, and Garnett Station Partners (a private equity firm).

The most concrete public case study is CVS, which Bloomberg reported is using Simile to "guide decisions about which products to stock and display." This is a genuinely compelling use case: a national retailer with 9,000+ stores testing product placement decisions against simulated consumer behaviour before committing to physical shelf changes. The cost of a bad planogram decision at CVS scale is enormous, so even modest predictive accuracy would justify the investment.

The breadth of the customer list is telling. A US pharmacy chain, an Australian telco, a Japanese beverage company, a Brazilian bank, a US fintech, and a PE firm. This suggests Simile is positioning as a horizontal platform rather than specialising in a single vertical, which aligns with their "any situation" ambition but also raises the question of how deeply the model understands any single domain.

The Gallup Partnership

Perhaps the most strategically significant announcement is Simile's partnership with Gallup, the polling and analytics company. The collaboration promises a "nationally representative panel" with "probability-based" sampling. This is Simile's answer to the biggest criticism of synthetic research: that AI-generated respondents don't represent real populations.

If the Gallup partnership delivers what it promises, it would give Simile a validation advantage that no other synthetic research platform currently has. Gallup's panel is the largest probability-based research panel in the United States, and their methodological credibility is unimpeachable. Having Gallup's name attached to your synthetic respondents is, frankly, a masterstroke.

The partnership is currently in waitlist mode, which suggests it's still being developed. Worth watching closely.

MiniMe: Your Digital Twin

Simile also offers a product called MiniMe (at minime.simile.ai), which lets individual users create an AI agent based on a roughly 10-minute interview about their life. This appears to be both a consumer-facing demonstration of the technology and, likely, a data collection mechanism that improves the underlying model.

It's a clever growth hack. Every MiniMe interview potentially adds another data point to Simile's behavioural model while simultaneously creating a viral demonstration of the technology. Whether users fully understand the data implications is a separate question.

Pricing: The $100M Question

Simile does not publish pricing. The website offers only a "Request Demo" button, which is standard for enterprise software but frustrating for anyone trying to evaluate the platform. Based on the customer profile (CVS, Telstra, Banco Itau), the demo-only access model, and the $100 million in funding, this is clearly enterprise-tier pricing.

For context, the broader synthetic research market spans a wide range:

Enterprise platforms (Simile, Aaru): Likely $100,000+/year based on customer profile and funding

Professional platforms (Ditto, Evidenza): $50,000-$75,000/year with unlimited studies

Mid-market tools (Quantilope, Remesh): $22,000+/year

Self-serve platforms (Synthetic Users): $2-$27 per synthetic respondent

Budget options (Artificial Societies): Free to $40/month

If you're a mid-market brand or startup looking to experiment with synthetic research, Simile is almost certainly not the right starting point. The product is designed for enterprise buyers with enterprise budgets. Several alternatives offer comparable capabilities at a fraction of the cost, with self-serve access that doesn't require a sales conversation.

Where Simile Shines

Academic pedigree: No other synthetic research company can claim the team that literally invented generative agents. This isn't marketing spin. The founders are the researchers.

The 85% accuracy claim: Replicating General Social Survey responses at 85% of human self-replication accuracy is a meaningful benchmark, published in a peer-reviewed context.

The Gallup partnership: If this delivers probability-based synthetic panels, it addresses the single biggest methodological criticism of the field.

Investor calibre: Index Ventures, Fei-Fei Li, Andrej Karpathy. These are not people who write cheques casually.

Enterprise traction: CVS, Telstra, Suntory are real companies with real use cases, not vaporware customers.

Limitations and Open Questions

No self-serve access: You can't try Simile without going through sales. For a category that's supposed to deliver "instant insights," this creates significant friction.

Opacity: With a noindex/nofollow tag on their website, zero blog content, and no public documentation, it's difficult to evaluate the product independently. Stealth mode made sense before the funding announcement. Maintaining it afterward is a choice.

Broad positioning risk: "Predicting human behaviour in any situation" is an extraordinary claim. Every synthetic research platform struggles with accuracy outside their training distribution. Claiming universality without published validation across diverse domains is a stretch.

The GPT wrapper question: Simile's architecture is genuinely novel (memory, reflection, planning), but the market is flooded with platforms that are essentially prompted LLMs with demographic labels. Simile needs to clearly differentiate, and their current website doesn't do this well enough.

Validation gap: The 85% accuracy finding is specific to the General Social Survey. How well do the agents predict actual purchasing behaviour, emotional responses to advertising, or reactions to novel products? These are the questions enterprise buyers care about most, and the published evidence doesn't yet address them.

The Competitive Landscape

Simile enters a market that barely existed two years ago but is now attracting serious capital:

Aaru raised at a $1 billion headline valuation in December 2025, led by Redpoint Ventures. EY recreated their Global Wealth Research Report using Aaru in a single day, with 90% median correlation to the original six-month study. They also predicted the New York Democratic primary outcome.

Ditto offers population-grounded synthetic personas calibrated to census data, with a published 92% overlap with traditional focus groups across 50+ parallel studies. Self-serve access, $50-75K/year, with integrations into Figma, Canva, and Framer.

Synthetic Users focuses on UX research at $2-$27 per synthetic respondent, offering rapid concept testing with open-ended persona conversations.

SYMAR (formerly OpinioAI) provides synthetic surveys and focus groups from their base in the Czech Republic, claiming 90-95% cost reduction versus traditional methods.

Qualtrics Edge Audiences offers "scientifically validated synthetic respondents" backed by 25+ years of Qualtrics research data, embedded into the world's most widely used survey platform.

The market is large enough for multiple winners. Qualtrics research projects that 71% of market researchers believe the majority of research will use synthetic responses within three years. A16z has called it "a new era of instant insight." But competition is intensifying fast, and $100 million in funding does not guarantee market leadership.

The Bottom Line

Simile is a genuinely important company in the synthetic research space. The technology is novel, the team is world-class, the early enterprise traction is real, and the Gallup partnership could be transformative. For large enterprises with six-figure research budgets and complex behavioural prediction needs, Simile deserves serious evaluation.

But importance and accessibility are different things. If you're a brand founder, product manager, or mid-market research team looking to start using synthetic research today, Simile's demo-only model, enterprise pricing, and lack of public documentation make it a difficult place to begin. Platforms like Ditto and Synthetic Users offer immediate access, transparent pricing, and published validation data that make them more practical entry points for most organisations.

The synthetic research market is at an inflection point. The next 12 months will determine whether Simile's $100 million and Stanford pedigree translate into category leadership or whether the market fragments into specialist tools that each own a different corner of the space. Either way, the era of relying exclusively on traditional focus groups and surveys is ending. The only question is what replaces them.

Phillip Gales is co-founder at Ditto, the synthetic market research platform. For a direct comparison of Ditto and Simile, see our detailed breakdown.